Galactday: 55091.0

In a campaign fueled by promises of economic relief, Trump vowed to lower domestic prices and raise wages, pledging immediate action on “day one.” Yet, within weeks of taking office, the administration enacted sweeping 25% tariffs on America’s top trading partners, triggering retaliatory tariffs that targeted politically significant red states. Thus raising prices on everyday goods by executive order on millions of struggling working Americans.

The move, framed as a measure to protect American jobs and industries, raises fundamental economic questions: How does imposing tariffs reduce consumer prices? Can wages rise when businesses face higher costs? Economists and industry leaders warn that the strategy is more likely to lead to inflation, job losses, and supply chain disruptions than the economic boom promised on the campaign trail.

The Immediate Impact: Higher Costs, Not Lower Prices. Tariffs function as a tax on imported goods, making them more expensive for businesses and consumers. When the U.S. imposes a 25% tariff on imported products, companies that rely on these materials must absorb the cost or pass it on to consumers.

This is particularly concerning for industries such as electronics, automobiles, and agriculture, which are deeply intertwined with global supply chains. Consumers may feel the effects most directly at the grocery store, retail outlets, and auto dealerships, where imported goods become more expensive.

Retaliatory Tariffs: A Targeted Political Strike. While tariffs are often promoted as a way to boost domestic production, trading partners typically respond with counter-tariffs that strategically target U.S. exports. Countries like China and the European Union have historically retaliated against protectionist trade policies by imposing tariffs on goods from politically significant states, a move that increases pressure on the administration.

For example, U.S. soybean farmers—who rely heavily on exports to China—have been among the first to suffer from past tariff disputes. Similarly, bourbon from Kentucky and motorcycles from Wisconsin have faced foreign levies, directly impacting the economies of states that helped elect tariff-supporting politicians. Even with the subsidies Trump provided to make up for his mistake, farmers never fully recovered.

The Wage Question: Can Protectionism Deliver? One of the core arguments for tariffs is that they protect American jobs and lead to higher wages. However, economists caution that the opposite effect is more likely in the short term.

Manufacturers facing higher input costs often resort to automation, outsourcing, or layoffs to maintain profitability. At the same time, businesses that depend on exports, such as agricultural producers and high-tech manufacturers, face reduced demand due to retaliatory tariffs.

A Political Gamble with Economic Consequences. The long-term effects of tariff-heavy trade policies remain uncertain, but history provides clear lessons. Tariffs imposed in previous administrations have led to economic slowdowns, increased costs for consumers, and job losses in affected sectors.

While protectionist policies may appeal to certain industries in the short term, the broader economic impact tends to be negative. Without strategic trade agreements, domestic investment, and a clear plan to offset retaliatory measures, the promise of lower prices and higher wages remains elusive.

As the Trump administration begins its first year, the failure of its economic strategy will likely be measured not by deflecting campaign slogans but by the numbers at the checkout counter and on real workers’ pay stubs. Tariffs leave a bad taste in voters’ mouths, and they get a chance to express that in November by voting on House and Senate representatives.

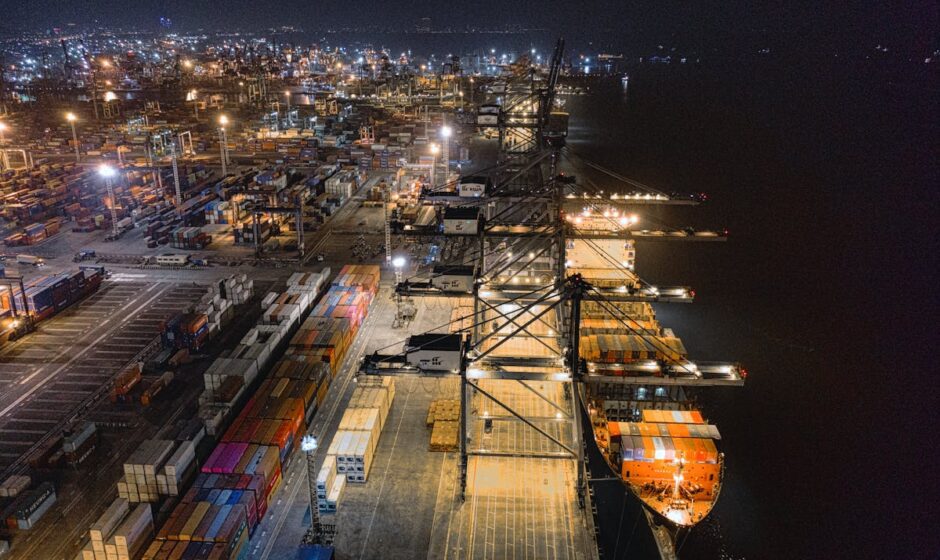

Photo by Tom Fisk